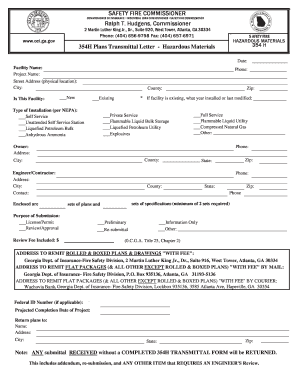

Get the free ga 354 form

Get, Create, Make and Sign

How to edit ga 354 form online

How to fill out ga 354 form

How to fill out ga 354 form:

Who needs ga 354 form:

Video instructions and help with filling out and completing ga 354 form

Instructions and Help about 354 fire marshal form

Support vector machines have a lot of terminology associated with them brace yourself hello I'm Josh stormed and welcome to stat quest today we're going to talk about support vector machines, and they're going to be clearly explained note this stack quest assumes that you are already familiar with the trade-off that plagues all machine learning the bias-variance trade off you should also be familiar with cross-validation if not check out the quests the links are in the description below let's start by imagining we measured the mass of a bunch of mice the red dots represent mice that are not obese and the green dots represent mice that are obese based on these observations we can pick a threshold and when we get a new observation that has less mass than the threshold we can classify it as not obese and when we get a new observation with more mass than the threshold we can classify it as obese however what if we get a new observation here because this observation has more mass than the threshold we classify it as obese, but that doesn't make sense because it is much closer to the observations that are not obese, so this threshold is pretty lame can we do better yes going back to the original training data set we can focus on the observations on the edges of each cluster and use the midpoint between them as the threshold now when a new observation falls on the left side of the threshold it will be closer to the observations that are not obese than it is to the obese observations, so it makes sense to classify this new observation as not obese BAM no it's a terminology alert the shortest distance between the observations and the threshold is called the margin since we put the threshold halfway between these two observations the distances between the observations and the threshold are the same and both reflect the margin when the threshold is halfway between the two observations the margin is as large as it can be for example if we move the threshold to the left a little then the distance between the threshold and the observation that is not obese would be smaller and thus the margin would be smaller than it was before and if we move the threshold to the right a little then the distance between the obese observation and the threshold would get smaller and again the margin would be smaller when we use the threshold that gives us the largest margin to make classifications heads up terminology alert we are using a maximal margin classifier BAM no no BAM maximal margin classifiers seem pretty cool but what if our training data looked like this, and we had an outlier observation that was classified as not obese but was much closer to the obese observations in this case the maximum margin classifier would be super close to the obese observations and really far from the majority of the observations that are not obese now if we got this new observation we would classify it as not obese even though most of the not obese observations are much further away than...

Fill 354 ga state fire marshal form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ga 354 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.